When buying or selling a small business, one question always comes up: How reliable are the financials? Whether you’re an SBA Lender, M&A Advisor, Buyer, or Seller, the goal is the same — to confirm that reported earnings truly reflect how the business performs. GCF Valuation offers two specialized services to help you get there: Add-Back [...] Read More... from Add-Back Tracing® vs. Quality of Earnings: Which One Do You Really Need? The post Add-Back Tracing® vs. Quality of Earnings: Which One Do You Really Need? appeared first on GCF.

When buying or selling a small business, one question always comes up: How reliable are the financials? Whether you’re an SBA Lender, M&A Advisor, Buyer, or Seller, the goal is the same — to confirm that reported earnings truly reflect how the business performs.

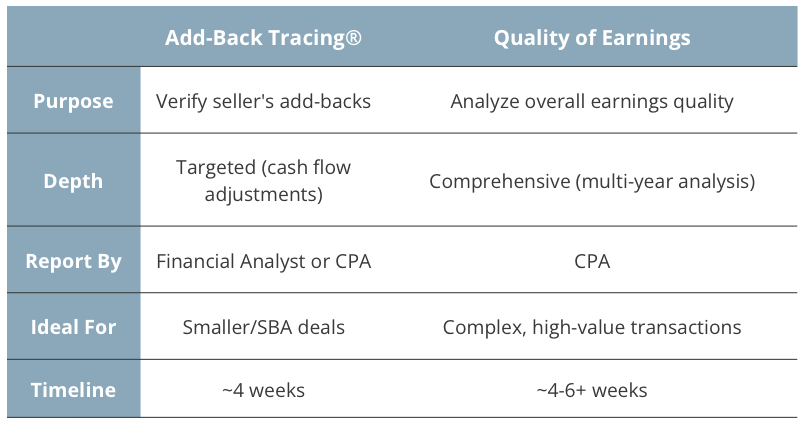

GCF Valuation offers two specialized services to help you get there: Add-Back Tracing® and a Quality of Earnings (QoE) report. Both provide essential financial clarity — but each serves a different purpose.

What is Add-Back Tracing®?

Add-Back Tracing® verifies and documents the seller’s claimed (Income Statement Adjustments) commonly referred to as “Add-Backs” — those one-time, personal, or non-operational expenses that a seller says won’t transfer with the sale.

Our analysts trace every add-back to its source, typically through tax returns and general ledger documentation.

If it can’t be isolated and/or verified, it can’t be counted.

- Best for: Smaller transactions, SBA loans, and lifestyle businesses with many owner add-backs

- Users: Sellers, Buyers, SBA lenders, and M&A Advisors

- Deliverable: A third-party report itemizing each verified add-back with supporting tax documentation

An Add-Back Tracing® report strengthens the credibility of the transaction for all parties — giving lenders confidence, buyers peace of mind, and sellers a verified adjusted cash-flow number to support valuation and underwriting.

When to use Add-Back Tracing®

Use Add-Back Tracing® when a business’s financials include numerous discretionary or personal expenses — the classic “owner lifestyle” situation.

It’s ideal for:

- SBA-funded transactions, where lenders need verified, documented adjustments

- Main-street and lower-middle-market deals that don’t require full CPA-level diligence

- Transactions where valuation depends heavily on cash-flow adjustments, such as businesses with family payroll, personal vehicles, or one-time costs

In these cases, Add-Back Tracing® isolates true, recurring earnings so everyone can proceed with confidence.

What is a Quality of Earnings Report?

A Quality of Earnings (QoE) report is a deeper dive — an analysis designed to assess the sustainability and accuracy of a company’s earnings. While it includes the verification of add-backs, a QoE takes it one step further and evaluates the company’s overall financial performance. It normalizes EBITDA, reviews trends, and identifies risks that could affect future cash flow.

- Best for: Larger or more complex transactions, carve-outs, and institutional buyers

- Users: Institutional buyers, lenders, sellers, and private-equity groups

- Deliverable: CPA-signed report with normalized financials and a detailed analysis of earnings quality

A QoE typically examines multiple years of data, analyzes margins and working capital, reviews customer or revenue concentration, and identifies irregularities or non-recurring items. The result: a comprehensive, lender- and investor-ready view of the business’s true earnings power.

When to Use a Quality of Earnings Report?

Use a QoE when:

- The deal is large, multi-location, or high-stakes

- Investors or lenders require deeper assurance

- The target company has complex structures, customer concentration, or multi-year performance questions

QoE is designed for full diligence — ideal for corporate divestitures, multi-unit carve-outs, and transactions backed by institutional or private-equity funding.

Add-Back Tracing® vs. Quality of Earnings

Simple deal? Use Add-Back Tracing®. Complex or high-stakes? Use QoE.

These tools often work together — an Add-Back Tracing® may precede a QoE, giving stakeholders a clear starting point before deeper diligence.

The Bottom Line: When to Use Which and Why It Matters

Add-Back Tracing® and Quality of Earnings reports are complementary, not competitive. Both are designed to help buyers, sellers, and lenders move through transactions with confidence — the difference lies in the depth of analysis and the purpose of the review.

- Add-Back Tracing® verifies the details behind the seller’s adjustments.

- Quality of Earnings examines the full financial picture.

By choosing the right level of review for your transaction, you can avoid surprises, reduce risk, and keep your closing on schedule.

At GCF Valuation, our accredited team has supported thousands of SBA-funded transactions with independent, defensible financial analyses — helping Lenders, M&A Advisors, and Business Owners Keep Small Business Moving.

Contact us to discuss which service is right for your next transaction.

Keep Learning About Business Valuations

How to Navigate The Business Valuation Process Successfully

The Great Debate: Business Valuation With or Without Inventory

What Is Business Valuation? Why & When You Need One

Our Accreditations

Your GCF Business Valuation appraisal team has one or more of the following business valuation accreditations:

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Accredited Senior Appraiser (ASA) – is recognized as having achieved the highest level of education, training, and report writing for business valuations. The ASA designation is the gold standard for a business valuation professional. (source: American Society of Appraisers)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Business Appraiser (CBA) – a very prestigious credential in the eyes of all who are familiar with it as it earned the reputation of being a difficult credential to obtain. (source: National Association of Certified Valuators and Analysts®)

Certified Valuation Analyst (CVA)

Certified Valuation Analyst (CVA) Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

Accredited in Business Valuation by the American Institute of CPAs (ABV by AICPA) – a credential granted exclusively by the AICPA to qualified valuation professionals who demonstrate expertise in valuation through knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Accredited in Business Valuation (ABV) – credential is granted exclusively by the AICPA to CPAs and qualified valuation professionals who demonstrate considerable expertise in valuation through their knowledge, skill, experience, and adherence to professional standards. (source: American Institute of CPAs)

- Certified Public Accountant (CPA)

Over 25 years of experience and expertise in business valuations and appraisals. An accredited appraiser receives extensive training, remains in good standing, and follows specific industry practices to determine the value of a business.

GCF’s Machinery and Equipment Appraisal Accreditations

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

Expert Equipment Certified Appraiser (EECA) – Our appraisers are recognized with a deep understanding of valuation principles and extensive experience by the Institute of Equipment Valuation.

- Certified Machinery and Equipment Appraiser (CMEA) – a CMEA professional has the expertise and certification to conduct a third party machinery and equipment appraisal.

The post Add-Back Tracing® vs. Quality of Earnings: Which One Do You Really Need? appeared first on GCF.