Unsure about equipment lease versus loan? Compare ownership, costs, & taxes to find the best financing for your business growth. The post Equipment Leasing vs Financing—Which Side Are You On? appeared first on Noreast Capital.

Equipment Lease Versus Loan: Your #1 Smart Choice

Navigating Your Equipment Acquisition Options

Making smart, strategic choices about equipment acquisition is a cornerstone of sustainable business growth. Whether you’re launching a new venture, expanding operations, or replacing outdated machinery, the tools you use are the engine of your productivity and profitability. However, acquiring high-value equipment often comes with a significant price tag, presenting a critical financial challenge. This is where the decision between an equipment lease versus loan becomes one of the most important a business owner can make. Both financing methods provide a pathway to getting the gear you need without depleting your cash reserves in a single transaction, but they operate on fundamentally different principles and have vastly different impacts on your company’s financial health.

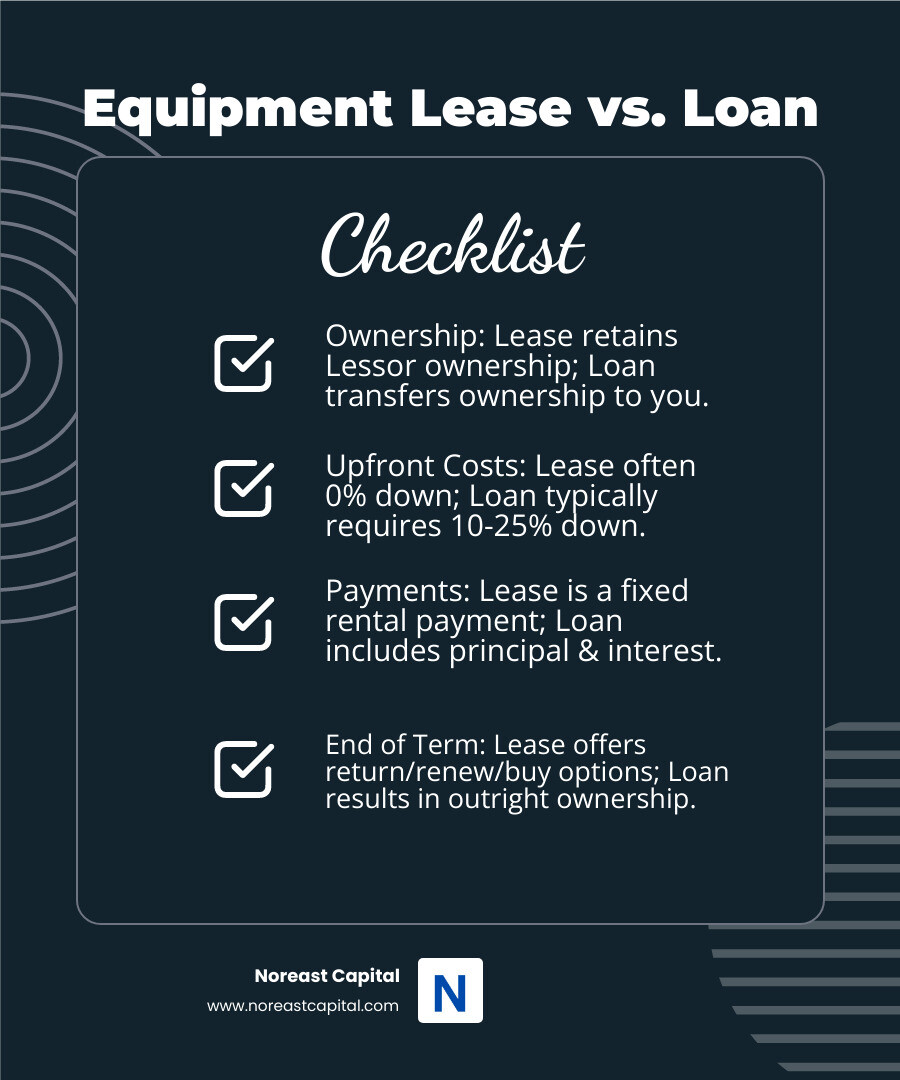

Here’s a quick look at the main differences:

| Feature | Equipment Lease | Equipment Loan |

|---|---|---|

| Ownership | Leasing company owns equipment | Your business owns equipment |

| Upfront Cost | Often no down payment | Typically 10-25% down payment |

| Payments | Fixed monthly “rental” payments | Principal + interest, can be fixed or variable |

| End of Term | Return, renew, or purchase option | You own the equipment outright |

Understanding these distinctions is crucial. An equipment lease functions like a long-term rental; you pay for the use of the asset, preserving your capital for other business needs. This is ideal for technology that quickly becomes obsolete. An equipment loan, conversely, is a path to ownership. You borrow funds to purchase the asset, building equity over time, which is perfect for equipment with a long, durable lifespan.

I’m Vincent Cerniglia. As a direct lender at Noreast Capital, I specialize in providing nationwide finance and leasing solutions. I’ve spent years helping businesses in Annapolis, Baltimore, Washington, DC, and across the country steer the complexities of equipment lease versus loan options. My goal is to help you find the perfect fit that aligns with your financial strategy and operational objectives, ensuring you’re positioned for success.

Equipment lease versus loan terms to know:

- business equipment loan rates

- equipment financing tax benefits

- For official guidelines on deducting business expenses, you can consult this resource on Tax information for businesses from the IRS.

The Core Differences: An Equipment Lease Versus Loan Breakdown

When it comes to acquiring essential equipment, the choice between an equipment lease versus loan isn’t just about semantics; it’s about fundamentally different financial structures that impact your business in distinct ways. This decision affects your cash flow, balance sheet, tax liability, and operational flexibility. We’re here to help you understand the immediate differences in commitment, cost, and requirements. Let’s explore the nuts and bolts of each option, helping you grasp what makes them tick so you can make an informed choice that fuels your company’s future.

What is an Equipment Lease vs. an Equipment Loan?

At its heart, an equipment lease is a sophisticated long-term rental agreement. When you lease equipment, you enter into a contract with a leasing company (the lessor) to use an asset for a predetermined period in exchange for regular payments. Crucially, ownership of the equipment remains with the lessor throughout the lease term. You, the business using the equipment, are the lessee. This “pay-for-use” model is a powerful tool for managing capital. It allows you to access state-of-the-art equipment—be it medical technology, construction machinery, or IT hardware—without the hefty upfront cost of purchase. This is particularly appealing for businesses in fast-evolving industries where technology can become obsolete in just a few years. By leasing, you transfer the risk of obsolescence to the leasing company. To dive deeper, you can learn more about How Does Equipment Leasing Work? and get familiar with common Leasing Terminology.

On the flip side, an equipment loan is a form of debt financing specifically designed for purchasing assets. You borrow a lump sum from a lender (like a bank or a specialized financing company) to buy the equipment outright. From day one, your business is the legal owner of the equipment. You then repay the loan, plus interest, over an agreed-upon term through regular installments. The equipment itself typically serves as collateral for the loan. This structure is analogous to a car loan or a mortgage on a house—it’s a vehicle for ownership. An equipment loan is the ideal choice when your strategic goal is long-term ownership and building equity in your company’s tangible assets. This is best suited for durable equipment with a long useful life that won’t need to be replaced frequently.

So, the simplest way to frame the equipment lease versus loan distinction is this: leasing means you’re borrowing the equipment, while a loan means you’re borrowing money to buy the equipment. Each path serves a different strategic purpose, and the right choice depends entirely on your business’s financial situation, growth plans, and philosophy on asset ownership.

Ownership, Upfront Costs, and Payment Structures

Let’s break down the practical implications of an equipment lease versus loan across the key financial aspects that will directly affect your budget and balance sheet.

| Feature | Equipment Lease | Equipment Loan |

|---|---|---|

| Ownership | Lessor retains ownership | Borrower owns the equipment from day one |

| Down Payment | Often $0 down or first/last month payment | Typically 10-25% of the equipment cost |

| Monthly Payments | Generally lower, fixed “rental” payments | Higher payments covering principal + interest |

| End-of-Term | Return, renew, or purchase the equipment | Own the equipment free and clear |

Ownership and Control

With a loan, ownership is straightforward: the equipment is yours. It’s an asset on your balance sheet from the moment you acquire it. This gives you complete control. You can customize, modify, or even sell the equipment (though you’d still have to settle the outstanding loan balance). This equity-building approach can strengthen your company’s financial standing over time. With a lease, the lessor owns the asset. This means you may face restrictions on how you can use or alter the equipment. However, it also means you aren’t tied to an aging asset. At the end of the term, you can simply walk away, upgrade to a newer model, or choose to purchase it, offering immense flexibility.

Upfront Costs and Capital Preservation

This is one of the most significant differentiators. Equipment loans almost always require a substantial down payment, typically ranging from 10% to 25% of the total cost. For a $100,000 piece of machinery, that’s a $10,000 to $25,000 upfront cash outlay. This can strain working capital that could otherwise be used for marketing, inventory, or hiring. Leases, in contrast, are renowned for their low-to-no down payment requirements. Often, you only need to provide the first and last month’s payment to get started. This 100% financing model is a powerful tool for preserving cash and keeping your credit lines open for other operational needs.

Payment Structures and Budgeting

Loan payments consist of two parts: principal (the amount you borrowed) and interest (the cost of borrowing). These can be at a fixed or variable rate. While fixed rates offer predictability, variable rates can fluctuate, making budgeting more challenging. Lease payments are simpler. They are typically fixed monthly payments calculated based on the equipment’s cost, the lease term, and its estimated residual value at the end of the term. These payments are treated as an operating expense, much like rent or utilities, making them highly predictable and easy to incorporate into your annual budget. This simplicity is a major draw for businesses focused on stable, manageable cash flow. Noreast Capital offers a variety of Leasing Plans to match different budgeting needs.

Qualification, Collateral, and Approval Process

Choosing between an equipment lease versus loan also means navigating two very different approval experiences. Because time is money, understanding how long paperwork will take—and what collateral you must pledge—can tilt the scales toward one option or the other.

| Criteria | Typical Equipment Lease | Typical Equipment Loan |

|---|---|---|

| Credit Requirements | Mid-600 FICO and above; newer businesses accepted | Higher credit scores preferred; 2+ years in business |

| Financial Documentation | 1-page application up to ~$250k; bank statements | Full financials, tax returns, business plan |

| Collateral | Primarily the equipment itself (“asset-based”) | Equipment + blanket liens or additional collateral |

| Approval Speed | 24–48 hours for most requests | 1–4 weeks, depending on lender |

Why leases approve faster: Lessors focus on the resale value of the asset, so they rely less on deep dives into your corporate financials. That single trait allows many small and mid-sized businesses in Annapolis, Baltimore, and Washington, DC to get the green light within days and deploy the new equipment on schedule.

Collateral considerations: With a loan, lenders often file a blanket Uniform Commercial Code (UCC) lien against all business assets—tying up future borrowing capacity. Leases typically restrict the lien to the specific equipment being financed, keeping your other assets free and clear.

Ready to see which option you qualify for? You can start a secure, no-obligation Credit Application with Noreast Capital and receive personalized terms in as little as one business day.

By pairing the right approval process with your timeline and collateral comfort level, you’ll be able to select the equipment financing structure that keeps your projects moving and your balance sheet healthy.

The post Equipment Leasing vs Financing—Which Side Are You On? appeared first on Noreast Capital.